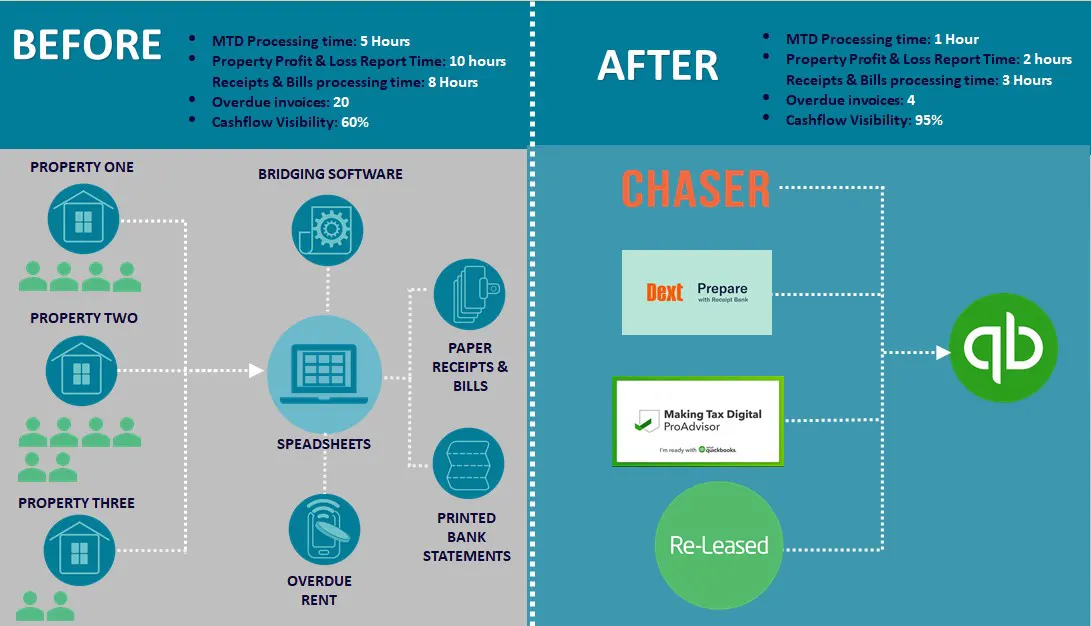

Not being able to keep on top of income and expenditure for multiple properties can leave you dazed and not in control of your cashflow.

On top of that you must get ready to be compliant for Making Tax Digital and submit digital records, rental values, Income, and expenses directly to HMRC

We have specific and tailored services that can help Landlords have a better peace of mind.

Better Bookkeeping Solutions can provide Cloud Accounting Software and Apps at better prices at reduced prices. In addition, we can save you the time and money researching, Implementing, and operating cloud software.